Over the past nearly decade, the investors in Agri land in Karnataka have included real estate investors, non-resident Indians, and other businessmen.

Hence, this interest is driven by the increasing number of green investment products, niches in agricultural technology, and the rise of sustainable yearly land value.

However, legal provisions govern the purchase of agricultural land in Karnataka, especially for non-culturists. Understanding these matters is essential, especially for any interested party seeking to invest responsibly.

This blog provides a legal guide for potential investors in agricultural land in Karnataka, making the investment process easy and efficient for anyone without an agriculturist background.

What is Agricultural Land in Karnataka?

Agricultural land in Karnataka is primarily used for farming and related activities. This land is classified into various types based on its utility:

- Dry Land – Suitable for rain-fed crops and minimal irrigation.

- Wetland – Used for paddy and other water-intensive crops.

- Forest Land – Reserved for forest conservation and requires special permissions for use.

The agricultural land is essential to this state since it plays an important role in food production, employment opportunities, and rural development.

So, it gives investors every reason to be convinced that it has all the future to grow to be much more significant in the coming years.

That is why any person planning to buy agricultural land in Karnataka should consider the following factors;

The Karnataka Land Reforms Act governed the amount of land acquired by a person residing in Karnataka, passed in 1961.

In particular, its primary purpose is to protect the owners of agricultural-related lands and to ensure that such land shall not be utilised primarily for non-agricultural purposes. Key legal aspects include:

Restrictions for Non-Agriculturists

- Any person not engaged in agriculture is prohibited from owning agricultural land, but he can do so under the following circumstances.

- Even after the amendment of the Karnataka Land Reforms Act in the year 2020, with some limitations opening up, the non-agriculturalists also have to fulfil some of the criteria.

Land in Rural vs. Urban Areas

- Country regions are regulated more than urban ones.

- The right to use land for urban agricultural activity can be changed to another type of use provided by the government.

Income Limitations

- Earlier, there was a bar or cap to buying agricultural land in India if the person has non-agricultural income of more than ₹ 25 lakhs in a year.

- This has, however, been eliminated in past amendments, creating room for professionals and business persons.

Who is Considered an Agriculturist in Karnataka?

To buy agricultural land in Karnataka , one must be classified as an agriculturist. Criteria include:

- Owning Agricultural Land – The individual or their family must own agricultural land in Karnataka.

- Farming Background – Proof of engagement in farming activities is required.

Being an agriculturist provides access to land ownership without restrictions, making it easier to navigate legal processes.

Can a Non-Agriculturist Buy Agricultural Land in Karnataka?

Buying of agricultural land by non-agriculturists in Karnataka is beset with legal challenges. However, there are specific conditions under which they can proceed:

Special Approvals

- Applications can be made to local authorities, demonstrating the intent to use the land for agricultural purposes.

- Government departments may issue permissions after reviewing the application.

NRI Investments

- For NRIs, the rules and regulations of FEMA are to be followed.

- An NRI is restricted from directly purchasing agricultural land unless he fulfils the criteria of being an agriculturist.

Post-Amendment Changes

- Recent legislative changes have eased the rules, allowing non-agriculturists to invest under specific conditions.

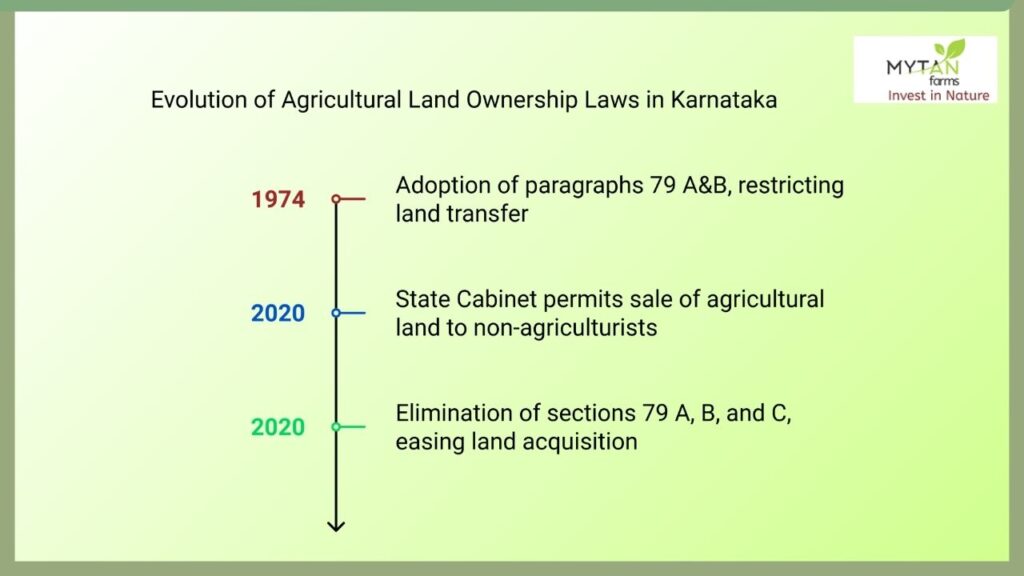

According to Urban Farmers, significant changes were made in the Karnataka Land Reforms Act 1961 section.

The State Cabinet in 2020 permitted the sale of agricultural land to non-aculturists. Still for it, it was decided to lift the cap on income from sources other than agriculture. It has also created a situation where the number of units of land one owns has increased.

Non-farmers could not acquire agricultural property before except for educational and religious purposes, companies and co-operatives.

Similarly, people with an Agricultural background can no longer buy agricultural land in Karnataka even if their annual non-agricultural income is more than 25 lakh Rupees.

The 79 A&B paragraphs adopted in 1974 required purchasers to make false statements to the tax administration.

Therefore, the problem caused the government to change section sixty-three, which increased the maximum amount of property a family or individual may acquire, and eliminate sections seventy-nine A, B, and C, which restricted the transfer of agricultural land.

By lifting the limit, the farmers can improve land rates and enhance their farming methods by strengthening investment and modicum.

Alternatives for Non-Agriculturists to Invest in Agricultural Land

If direct purchase is not an option, consider these alternatives:

- Leasing Agricultural Land

Non-agriculturists can lease land to engage in farming or agricultural projects. This allows temporary use without ownership.

- Joint Ventures

Partnering with certified agriculturists opens opportunities for shared investments.

- Agricultural Land Trusts

Invest in a trust or entity specialising in agricultural projects. This ensures compliance with legal regulations while reaping financial benefits.

Steps for Non-Agriculturists to Legally Purchase Agricultural Land

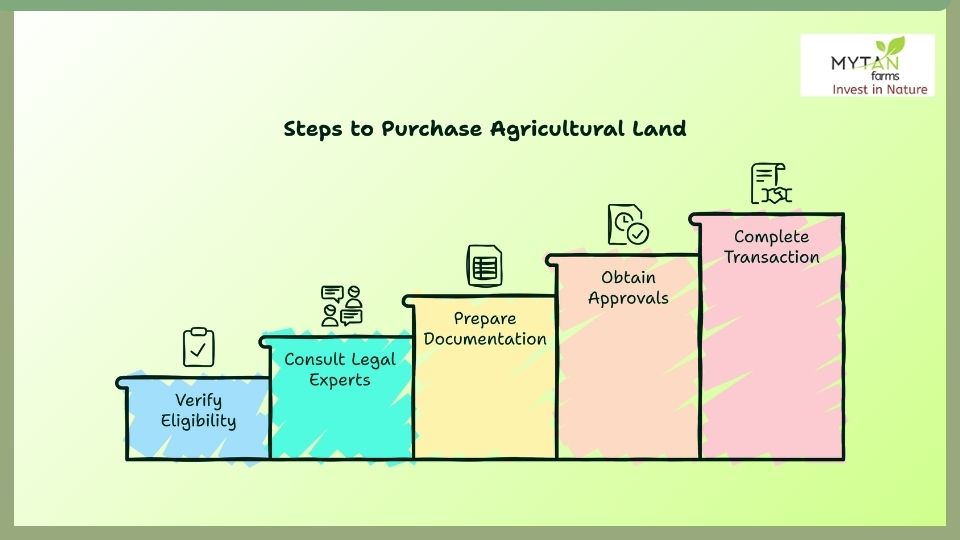

For non-agriculturists determined to buy agricultural land in Karnataka, here’s a step-by-step guide:

- Verify Eligibility

Confirm whether you meet the amended criteria under the Karnataka Land Reforms Act. - Consult Legal Experts

Seek advice from professionals familiar with local laws and land regulations. - Prepare Documentation

- Income proof, if required.

- Evidence of farming background or intent.

- Government-issued identification.

- Obtain Approvals

Submit applications to relevant authorities and await clearance. - Complete the Transaction

Once approved, finalise the purchase with all necessary legal documentation.

Obstacles Which Farmers Face In Purchase of Agricultural Land By Non-Agriculturists

Buying agricultural land as a non-agriculturist in Karnataka is not without its challenges:

- Bureaucratic Hurdles

The approval process is lengthy and complicated.

- Legal Risks

Misunderstanding or misinterpreting laws can lead to disputes.

- Zoning Restrictions

Land-use policies strictly regulate agricultural land, and its conversion for other purposes is restricted.

NRIs also have certain constraints, such as FEMA, and they deal with local property laws.

Prospect for those Non-Agriculturists in Agriculture Investment Holdings

Despite the challenges, investment in agricultural land presents huge opportunities:

- Sustainable Agriculture

Earning money while contributing to environmentally friendly farming practices.

- Long-Term Value Appreciation

Agricultural land is a stable investment that appreciates over time.

- Portfolio Diversification

Adding land investments to the financial portfolio will strengthen it by balancing risk and returns.

Conclusion

Navigating the complexities when people buy agricultural land in Karnataka requires careful planning and legal guidance. While non-agriculturists face certain restrictions, recent amendments and alternative investment options make it feasible.

Opportunities abound for those committed to exploring this sector, whether through leasing, partnerships, or direct purchase.

If you’re considering investing and decided to buy agricultural land in Karnataka, MyTanFarms offers expert assistance tailored to your needs.

Our team ensures compliance with all legal requirements, making your journey smoother. Connect with us today to explore Karnataka’s thriving agricultural sector!

FAQs

No, except when they come within the category of agriculturists under the Karnataka law.

Check the legal situation, seek professional advice, obtain permission, and complete the transaction.

Yes, it is valid for anyone who wants to invest and buy agricultural land in Karnataka; leasing can be a good idea.

NRIs face legal constrictions, compliance issues and procedures, and bureaucratic inhibitors.